ZZX

New member

Understanding how to see liquidity pool of a coin is essential for every DeFi trader and investor in 2025. This comprehensive guide covers everything from basic concepts to advanced analysis tools, helping you make informed decisions and avoid costly mistakes.

Table of Contents

What Are Liquidity Pools and Why They Matter

Learning how to see liquidity pool of a coin starts with understanding what liquidity pools are and why they're crucial for DeFi trading. Liquidity pools are collections of cryptocurrency assets locked in smart contracts that facilitate trading on decentralized exchanges (DEXes) without requiring traditional order books.

Why Liquidity Pools Are Essential

When you trade tokens on platforms like Uniswap or PancakeSwap, you're interacting directly with these liquidity pools. For example, swapping ETH for USDT happens within the ETH/USDT liquidity pool, where liquidity providers have deposited both tokens to facilitate trades.

The Importance of Pool Analysis

Before trading any token or providing liquidity, checking pool details is crucial for several reasons:

Key Liquidity Pool Metrics to Monitor

When learning how to see liquidity pool of a coin, you need to understand the critical metrics that indicate pool health and trading viability. Here are the essential metrics every trader should monitor:

Essential Pool Metrics

Advanced Metrics for Professional Analysis

Red Flags to Watch For

Step-by-Step Guide: Checking Pools on Major DEXes

Now let's explore how to see liquidity pool of a coin on the most popular decentralized exchanges. Each platform has its own interface, but the core information remains consistent.

Uniswap (Ethereum & Layer 2s)

Uniswap is the largest DEX by volume and offers comprehensive pool analytics.

Step-by-Step Process:

Key Information Available:

PancakeSwap dominates BNB Chain trading and offers excellent pool analytics.

Step-by-Step Process:

Unique PancakeSwap Features:

SushiSwap (Multi-Chain)

SushiSwap operates across multiple blockchains and provides unified pool analytics.

Step-by-Step Process:

Curve Finance (Stablecoin Pools)

Curve specializes in stablecoin and similar-asset pools with unique bonding curves.

Step-by-Step Process:

Advanced Analysis Tools and Platforms

Beyond individual DEX interfaces, several specialized tools provide comprehensive liquidity pool analysis across multiple platforms. These tools are essential for serious DeFi traders learning how to see liquidity pool of a coin effectively.

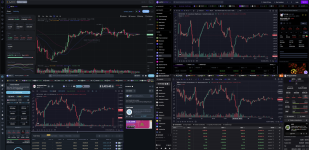

DEXTools: Comprehensive DeFi Analytics

DEXTools is one of the most popular platforms for liquidity pool analysis, supporting over 70 blockchain networks.

Key Features:

How to Use DEXTools:

DexScreener: Real-Time Multi-Chain Analytics

DexScreener provides real-time analytics across 80+ blockchain networks with an intuitive interface.

Key Features:

GeckoTerminal: CoinGecko's DEX Analytics

GeckoTerminal aggregates liquidity pool data with CoinGecko's trusted analytics.

Key Features:

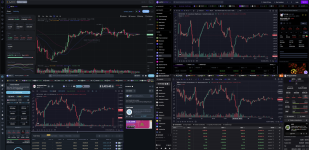

DexGuru: Professional Trading Terminal

DexGuru combines analytics with direct trading capabilities for professional traders.

Key Features:

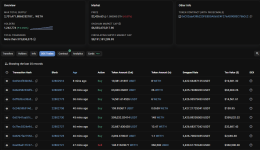

Using Blockchain Explorers for Deep Analysis

For the most detailed analysis of how to see liquidity pool of a coin, blockchain explorers provide direct access to smart contract data and transaction history. This level of analysis is crucial for identifying potential risks and understanding pool mechanics.

Etherscan (Ethereum)

Etherscan is the primary explorer for Ethereum and provides comprehensive smart contract analysis.

Analyzing Liquidity Pools on Etherscan:

Key Information to Look For:

BscScan (BNB Chain)

BscScan provides similar functionality for BNB Chain tokens and pools.

Key Features for Pool Analysis:

PolygonScan (Polygon)

PolygonScan offers comprehensive analysis for Polygon-based liquidity pools.

Unique Polygon Considerations:

Advanced Explorer Techniques

Reading Smart Contract Functions:

Identifying Red Flags:

Security and Risk Assessment

Understanding how to see liquidity pool of a coin includes knowing how to assess security risks and protect yourself from common DeFi threats. Security analysis is crucial for safe trading and liquidity provision.

Common Liquidity Pool Risks

Rug Pulls and Exit Scams:

Impermanent Loss:

Smart Contract Risks:

Security Verification Tools

Liquidity Lock Verification:

Contract Audit Platforms:

Risk Assessment Checklist

Before interacting with any liquidity pool, use this comprehensive checklist:

Team and Project Verification:

Technical Security:

Pool Health Indicators:

How DAOs Use Liquidity Pool Analysis

Understanding how to see liquidity pool of a coin is particularly important for DAO members and treasury managers. DAOs frequently interact with liquidity pools for treasury management, token launches, and community incentives.

DAO Treasury Management

DAOs use liquidity pool analysis for several critical treasury functions:

Diversification Strategies:

Token Launch Strategies:

DAO-Specific Pool Analysis

Governance Token Pools:

Treasury Token Pools:

Community Incentive Programs

Many DAOs use liquidity pools as part of their community incentive strategies:

Liquidity Mining Programs:

Partnership Opportunities:

Tools for DAO Pool Management

Specialized DAO Tools:

Next Steps and Best Practices

Now that you understand how to see liquidity pool of a coin, here are the essential next steps and best practices for implementing this knowledge effectively.

Developing Your Analysis Workflow

Daily Monitoring Routine:

Weekly Deep Analysis:

Advanced Strategies

Cross-Chain Arbitrage:

Yield Optimization:

Community and Continuous Learning

Join DeFi Communities:

Stay Updated on Developments:

Risk Management Best Practices

Portfolio Diversification:

Security Hygiene:

Tools and Resources Summary

Essential Bookmarks:

Mobile Apps for On-the-Go Analysis:

Conclusion

Understanding how to see liquidity pool of a coin is fundamental to successful DeFi trading and investment. This comprehensive guide has covered everything from basic concepts to advanced analysis techniques, providing you with the knowledge and tools needed to make informed decisions in the decentralized finance ecosystem.

Key takeaways from this guide:

Whether you're a beginner exploring DeFi for the first time or an experienced trader looking to refine your analysis skills, the tools and techniques covered in this guide will help you navigate liquidity pools with confidence. Remember that the DeFi space is constantly evolving, so continuous learning and adaptation are essential for long-term success.

As you continue your DeFi journey, consider exploring how decentralized autonomous organizations are revolutionizing governance and treasury management in this space. Understanding both the technical and organizational aspects of DeFi will give you a comprehensive view of this transformative financial ecosystem.

Ready to put your knowledge into practice? Start by analyzing a few well-established pools on major DEXes, then gradually explore more advanced tools and strategies as you build confidence and experience.

Table of Contents

- What Are Liquidity Pools and Why They Matter

- Key Liquidity Pool Metrics to Monitor

- Step-by-Step Guide: Checking Pools on Major DEXes

- Advanced Analysis Tools and Platforms

- Using Blockchain Explorers for Deep Analysis

- Security and Risk Assessment

- How DAOs Use Liquidity Pool Analysis

- Next Steps and Best Practices

What Are Liquidity Pools and Why They Matter

Learning how to see liquidity pool of a coin starts with understanding what liquidity pools are and why they're crucial for DeFi trading. Liquidity pools are collections of cryptocurrency assets locked in smart contracts that facilitate trading on decentralized exchanges (DEXes) without requiring traditional order books.

Why Liquidity Pools Are Essential

- Enable Token Swaps: Allow seamless trading without centralized intermediaries

- Reduce Slippage: Higher liquidity means less price impact during trades

- Power DeFi Functions: Enable yield farming, lending, and staking mechanisms

- Provide Earning Opportunities: Liquidity providers earn fees from trading activity

When you trade tokens on platforms like Uniswap or PancakeSwap, you're interacting directly with these liquidity pools. For example, swapping ETH for USDT happens within the ETH/USDT liquidity pool, where liquidity providers have deposited both tokens to facilitate trades.

The Importance of Pool Analysis

Before trading any token or providing liquidity, checking pool details is crucial for several reasons:

- Market Stability: High liquidity pools handle large trades without significant price changes

- Slippage Management: Low liquidity can cause expensive slippage during trades

- Scam Prevention: Helps identify fake tokens and potential rug pulls

- Investment Evaluation: Pools with higher Total Value Locked (TVL) are generally more reliable

Understanding liquidity pools is fundamental to DeFi success. Just as understanding DAOs helps you navigate decentralized governance, mastering liquidity analysis helps you navigate decentralized trading.

Key Liquidity Pool Metrics to Monitor

When learning how to see liquidity pool of a coin, you need to understand the critical metrics that indicate pool health and trading viability. Here are the essential metrics every trader should monitor:

Essential Pool Metrics

| Metric | Description | Why It Matters |

|---|---|---|

| Total Value Locked (TVL) | Total amount of assets held in the pool | Higher TVL indicates more liquidity and less slippage |

| 24-Hour Trading Volume | Total value of trades in the pool over 24 hours | High volume means active usage and better price discovery |

| Token Ratios | Proportion of each token in the pool | Helps gauge demand and potential arbitrage opportunities |

| APR/APY | Annual return earned by liquidity providers | Indicates potential rewards for providing liquidity |

| Number of LPs | Count of liquidity providers in the pool | More providers indicate decentralization and stability |

Advanced Metrics for Professional Analysis

- Volume-to-TVL Ratio: Indicates how efficiently the pool's liquidity is being utilized

- Fee Tier: Different fee structures (0.05%, 0.3%, 1%) affect returns and trading costs

- Price Impact: Shows how much a trade of specific size would affect the token price

- Liquidity Distribution: In V3 pools, shows how liquidity is concentrated across price ranges

- Historical Performance: Tracks pool metrics over time to identify trends

Red Flags to Watch For

- Sudden TVL Drops: May indicate large liquidity provider exits or potential issues

- Extremely High APR: Often indicates high risk or unsustainable tokenomics

- Low Trading Volume: Suggests poor liquidity and potential price manipulation

- Unbalanced Token Ratios: May indicate one-sided selling pressure

- Single Large LP: Creates centralization risk and potential for manipulation

Screenshot from DefiLlama

Step-by-Step Guide: Checking Pools on Major DEXes

Now let's explore how to see liquidity pool of a coin on the most popular decentralized exchanges. Each platform has its own interface, but the core information remains consistent.

Uniswap (Ethereum & Layer 2s)

Uniswap is the largest DEX by volume and offers comprehensive pool analytics.

Step-by-Step Process:

- Visit app.uniswap.org and connect your wallet

- Click on "Pool" in the top navigation menu

- Use the search bar to find your token by name or contract address

- Select the specific pool (e.g., ETH/USDC 0.3% fee tier)

- Review the pool overview showing TVL, volume, and fees

- Click "Add Liquidity" to see detailed pool composition

- Check the "Analytics" section for historical data and charts

Key Information Available:

- Real-time TVL and 24h volume

- Fee tier and accumulated fees

- Token reserves and current price

- Liquidity provider count

- Historical performance charts

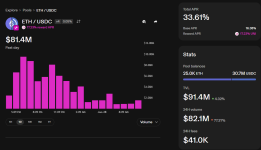

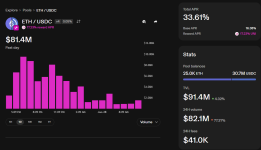

Screenshot from Uniswap ETH/USDC Pair

PancakeSwap (BNB Chain)PancakeSwap dominates BNB Chain trading and offers excellent pool analytics.

Step-by-Step Process:

- Navigate to pancakeswap.finance

- Connect your wallet and ensure you're on BNB Chain

- Click "Liquidity" in the main menu

- Search for your desired token pair

- Select the pool to view detailed metrics

- Use "Info" section for comprehensive analytics

- Check "Farms" section if the pool has additional rewards

Unique PancakeSwap Features:

- Integrated farming rewards display

- Cake token incentives information

- Cross-chain pool support

- Prediction market integration

- NFT marketplace liquidity pools

SushiSwap (Multi-Chain)

SushiSwap operates across multiple blockchains and provides unified pool analytics.

Step-by-Step Process:

- Visit app.sushi.com

- Select your preferred blockchain network

- Navigate to "Pool" section

- Search for the token pair you want to analyze

- Click on the pool for detailed information

- Use "Analytics" for historical data and trends

- Check "Onsen" for additional reward programs

Curve Finance (Stablecoin Pools)

Curve specializes in stablecoin and similar-asset pools with unique bonding curves.

Step-by-Step Process:

- Go to curve.fi

- Browse pools or search for specific assets

- Click on a pool to see detailed metrics

- Review the "Stats" section for comprehensive data

- Check "Gauge" information for CRV rewards

- Analyze the pool's bonding curve and slippage

Advanced Analysis Tools and Platforms

Beyond individual DEX interfaces, several specialized tools provide comprehensive liquidity pool analysis across multiple platforms. These tools are essential for serious DeFi traders learning how to see liquidity pool of a coin effectively.

DEXTools: Comprehensive DeFi Analytics

DEXTools is one of the most popular platforms for liquidity pool analysis, supporting over 70 blockchain networks.

Key Features:

- Real-time Pool Explorer: Track liquidity movements and new pool creation

- Advanced Charting: TradingView-powered charts with technical indicators

- Big Swap Tracker: Monitor large transactions that could impact prices

- Liquidity Lock Verification: Check if pool liquidity is locked or burned

- Multi-chain Support: Analyze pools across Ethereum, BSC, Polygon, and more

How to Use DEXTools:

- Visit dextools.io

- Select your blockchain network

- Search for the token or paste contract address

- Review the pool information panel

- Check the "Locks" section for liquidity security

- Analyze trading patterns and holder distribution

DexScreener: Real-Time Multi-Chain Analytics

DexScreener provides real-time analytics across 80+ blockchain networks with an intuitive interface.

Key Features:

- Live Price Tracking: Real-time price movements across all DEXes

- Volume Analysis: 24h volume, market cap, and liquidity metrics

- Custom Alerts: Price and volume alerts for specific tokens

- Portfolio Tracking: Monitor your liquidity positions

- Community Sentiment: User reactions and social signals

GeckoTerminal: CoinGecko's DEX Analytics

GeckoTerminal aggregates liquidity pool data with CoinGecko's trusted analytics.

Key Features:

- Pool Aggregation: Data from multiple DEXes in one interface

- Historical Charts: Long-term price and volume analysis

- Token Information: Comprehensive token details and social links

- Trending Pools: Discover popular and emerging liquidity pools

- API Access: For developers building custom analytics tools

DexGuru: Professional Trading Terminal

DexGuru combines analytics with direct trading capabilities for professional traders.

Key Features:

- Trading Terminal: Execute trades directly from the analytics interface

- Wallet Tracking: Monitor smart money and whale movements

- Portfolio Management: Track positions across multiple chains

- Advanced Charting: Professional-grade technical analysis tools

- Risk Assessment: Built-in tools for evaluating token and pool risks

Using Blockchain Explorers for Deep Analysis

For the most detailed analysis of how to see liquidity pool of a coin, blockchain explorers provide direct access to smart contract data and transaction history. This level of analysis is crucial for identifying potential risks and understanding pool mechanics.

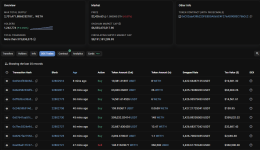

Etherscan (Ethereum)

Etherscan is the primary explorer for Ethereum and provides comprehensive smart contract analysis.

Analyzing Liquidity Pools on Etherscan:

- Visit etherscan.io

- Search for the token contract address

- Navigate to the "Holders" tab to see major liquidity pools

- Click on pool contract addresses (usually starting with 0x...)

- Review the "Contract" tab for verified source code

- Check "Token Transfers" for recent liquidity movements

- Analyze "Internal Transactions" for complex interactions

Key Information to Look For:

- Contract Verification: Verified contracts are more trustworthy

- Token Holdings: See exact token balances in the pool

- Transaction History: Track deposits, withdrawals, and swaps

- Creator Address: Identify who deployed the pool contract

- Liquidity Lock Status: Check if LP tokens are locked or burned

BscScan (BNB Chain)

BscScan provides similar functionality for BNB Chain tokens and pools.

Key Features for Pool Analysis:

- Token holder distribution analysis

- PancakeSwap pool identification

- Smart contract interaction tracking

- LP token lock verification

- Transaction fee analysis

PolygonScan (Polygon)

PolygonScan offers comprehensive analysis for Polygon-based liquidity pools.

Unique Polygon Considerations:

- Lower transaction fees enable more frequent analysis

- QuickSwap and SushiSwap pool tracking

- Bridge transaction monitoring

- Validator and staking pool analysis

- Layer 2 specific metrics

Advanced Explorer Techniques

Reading Smart Contract Functions:

- getReserves(): Shows current token balances in the pool

- totalSupply(): Total LP tokens issued

- balanceOf(): Check specific address LP token holdings

- token0() and token1(): Identify the two tokens in the pair

- factory(): Shows which DEX created the pool

Identifying Red Flags:

- Unverified smart contracts

- Recent large liquidity withdrawals

- Unusual transaction patterns

- Concentrated ownership of LP tokens

- Missing or suspicious lock contracts

Security and Risk Assessment

Understanding how to see liquidity pool of a coin includes knowing how to assess security risks and protect yourself from common DeFi threats. Security analysis is crucial for safe trading and liquidity provision.

Common Liquidity Pool Risks

Rug Pulls and Exit Scams:

- Definition: When developers drain liquidity pools, leaving investors with worthless tokens

- Warning Signs: Unlocked liquidity, anonymous teams, unrealistic promises

- Prevention: Always verify liquidity locks and team credentials

Impermanent Loss:

- Definition: Loss experienced when token prices diverge from initial deposit ratio

- Impact: Can reduce returns compared to simply holding tokens

- Mitigation: Choose stable pairs or use impermanent loss protection protocols

Smart Contract Risks:

- Bugs and Exploits: Code vulnerabilities can lead to fund loss

- Unaudited Contracts: Higher risk of unknown vulnerabilities

- Upgrade Risks: Proxy contracts can be changed by administrators

Security Verification Tools

Liquidity Lock Verification:

- Unicrypt: Popular platform for locking LP tokens

- Team.Finance: Another trusted liquidity locking service

- DxLocker: Multi-chain liquidity locking platform

- PinkLock: BSC-focused locking service

Contract Audit Platforms:

- CertiK: Professional smart contract auditing

- ConsenSys Diligence: Ethereum-focused security audits

- OpenZeppelin: Security tools and audit services

- Quantstamp: Automated and manual security analysis

Risk Assessment Checklist

Before interacting with any liquidity pool, use this comprehensive checklist:

Team and Project Verification:

- [ ] Team members publicly identified

- [ ] Active social media presence

- [ ] Clear project roadmap and documentation

- [ ] Community engagement and support

- [ ] Realistic tokenomics and use cases

Technical Security:

- [ ] Smart contract source code verified

- [ ] Professional security audit completed

- [ ] Liquidity locked for reasonable duration

- [ ] No unusual admin functions or backdoors

- [ ] Reasonable token distribution

Pool Health Indicators:

- [ ] Adequate TVL for intended trade size

- [ ] Consistent trading volume

- [ ] Multiple liquidity providers

- [ ] Balanced token ratios

- [ ] Reasonable fee structure

Security in DeFi requires constant vigilance. Just as creating a secure DAO requires careful planning and security measures, analyzing liquidity pools demands thorough due diligence and risk assessment.

How DAOs Use Liquidity Pool Analysis

Understanding how to see liquidity pool of a coin is particularly important for DAO members and treasury managers. DAOs frequently interact with liquidity pools for treasury management, token launches, and community incentives.

DAO Treasury Management

DAOs use liquidity pool analysis for several critical treasury functions:

Diversification Strategies:

- Multi-Pool Exposure: Spreading treasury assets across multiple stable pools

- Risk Assessment: Evaluating pool security before treasury deployment

- Yield Optimization: Finding the best risk-adjusted returns for DAO funds

- Liquidity Management: Ensuring sufficient liquidity for operational needs

Token Launch Strategies:

- Initial Liquidity Provision: Determining optimal initial pool composition

- Liquidity Incentives: Designing reward programs for early liquidity providers

- Price Stability: Managing token price through strategic liquidity management

- Community Distribution: Using liquidity mining for fair token distribution

DAO-Specific Pool Analysis

Governance Token Pools:

- Monitor voting power concentration in liquidity pools

- Assess impact of pool rewards on governance participation

- Track large holder movements that could affect governance

- Evaluate pool-based governance delegation mechanisms

Treasury Token Pools:

- Analyze correlation between different treasury assets

- Monitor impermanent loss impact on treasury value

- Track yield generation from treasury liquidity provision

- Assess exit liquidity for emergency fund access

Community Incentive Programs

Many DAOs use liquidity pools as part of their community incentive strategies:

Liquidity Mining Programs:

- Reward Distribution: Analyzing optimal reward rates and duration

- Participant Tracking: Monitoring community engagement and retention

- Economic Impact: Assessing program effectiveness on token price and adoption

- Sustainability Analysis: Ensuring long-term viability of incentive programs

Partnership Opportunities:

- Identifying potential collaboration pools with other DAOs

- Analyzing cross-protocol liquidity sharing opportunities

- Evaluating joint liquidity mining programs

- Assessing strategic partnership benefits through shared pools

Tools for DAO Pool Management

Specialized DAO Tools:

- Gnosis Safe: Multi-signature wallet for secure pool interactions

- Snapshot: Governance voting on liquidity strategies

- Coordinape: Community coordination for liquidity provision

- Parcel: Treasury management with pool analytics integration

- Llama: Institutional-grade treasury and liquidity management

Mantle Treasury from DefiLlama

Next Steps and Best Practices

Now that you understand how to see liquidity pool of a coin, here are the essential next steps and best practices for implementing this knowledge effectively.

Developing Your Analysis Workflow

Daily Monitoring Routine:

- Check TVL and volume trends for your active positions

- Monitor price impact and slippage for planned trades

- Review any new pools for tokens you're tracking

- Scan for unusual activity or large transactions

- Update your risk assessment based on market conditions

Weekly Deep Analysis:

- Comprehensive review of all pool metrics and trends

- Security verification for any new pools you're considering

- Comparison analysis across different DEXes and chains

- Portfolio rebalancing based on pool performance

- Research new tools and platforms for better analysis

Advanced Strategies

Cross-Chain Arbitrage:

- Monitor price differences across different blockchain networks

- Analyze bridge costs and timing for arbitrage opportunities

- Consider gas fees and transaction times in profit calculations

- Use tools like Li.Fi or Hop Protocol for efficient cross-chain swaps

Yield Optimization:

- Compare yields across different protocols and chains

- Factor in token rewards, trading fees, and potential impermanent loss

- Consider auto-compounding strategies and vault protocols

- Monitor yield farming opportunities and their sustainability

Community and Continuous Learning

Join DeFi Communities:

- Follow reputable DeFi researchers and analysts on Twitter

- Join Discord servers for major DeFi protocols

- Participate in governance discussions for protocols you use

- Attend virtual conferences and webinars on DeFi topics

- Contribute to open-source DeFi tools and documentation

Stay Updated on Developments:

- Subscribe to DeFi newsletters and research reports

- Monitor protocol upgrades and new feature releases

- Track regulatory developments affecting DeFi

- Follow security researchers for the latest threat intelligence

- Keep up with new blockchain networks and their DeFi ecosystems

Risk Management Best Practices

Portfolio Diversification:

- Never put all funds in a single pool or protocol

- Diversify across different blockchain networks

- Balance high-yield opportunities with stable, established pools

- Maintain emergency funds in easily accessible assets

- Regular portfolio rebalancing based on risk tolerance

Security Hygiene:

- Use hardware wallets for significant fund storage

- Regularly update wallet software and browser extensions

- Verify all contract addresses before interacting

- Use separate wallets for experimental DeFi activities

- Keep detailed records of all transactions and positions

Tools and Resources Summary

Essential Bookmarks:

- DEX Platforms: Uniswap, PancakeSwap, SushiSwap, Curve

- Analytics Tools: DEXTools, DexScreener, GeckoTerminal, DexGuru

- Blockchain Explorers: Etherscan, BscScan, PolygonScan

- Security Tools: Unicrypt, Team.Finance, RugCheck

- Portfolio Trackers: DeBank, Zapper, Zerion

Mobile Apps for On-the-Go Analysis:

- DEXTools mobile app for quick pool checks

- DexScreener mobile interface for price monitoring

- Wallet apps with built-in DeFi analytics

- Price alert apps for important pool metrics

- Portfolio tracking apps with DeFi integration

Mastering liquidity pool analysis is a journey, not a destination. The DeFi space evolves rapidly, and successful traders continuously adapt their strategies and tools. Start with the basics, practice with small amounts, and gradually build your expertise as you gain confidence and experience.

Conclusion

Understanding how to see liquidity pool of a coin is fundamental to successful DeFi trading and investment. This comprehensive guide has covered everything from basic concepts to advanced analysis techniques, providing you with the knowledge and tools needed to make informed decisions in the decentralized finance ecosystem.

Key takeaways from this guide:

- Start with the Basics: Master fundamental metrics like TVL, volume, and token ratios

- Use Multiple Tools: Combine DEX interfaces, analytics platforms, and blockchain explorers

- Prioritize Security: Always verify liquidity locks and assess smart contract risks

- Practice Risk Management: Diversify positions and never invest more than you can afford to lose

- Stay Informed: Keep up with protocol updates, security developments, and market trends

Whether you're a beginner exploring DeFi for the first time or an experienced trader looking to refine your analysis skills, the tools and techniques covered in this guide will help you navigate liquidity pools with confidence. Remember that the DeFi space is constantly evolving, so continuous learning and adaptation are essential for long-term success.

As you continue your DeFi journey, consider exploring how decentralized autonomous organizations are revolutionizing governance and treasury management in this space. Understanding both the technical and organizational aspects of DeFi will give you a comprehensive view of this transformative financial ecosystem.

Ready to put your knowledge into practice? Start by analyzing a few well-established pools on major DEXes, then gradually explore more advanced tools and strategies as you build confidence and experience.

Last edited: